Why Financial Management Is Very Important for Businesses

Financial management is a crucial part of any business. Whether you are the owner or an employee, financial management is key to ensuring that a business runs smoothly and grows. As a business owner, financial management will help you avoid financial hardships, such as bankruptcy, and keep your company running in tip-top shape. Managing finances well leads to smoother business operations and clear career paths for those who want them.

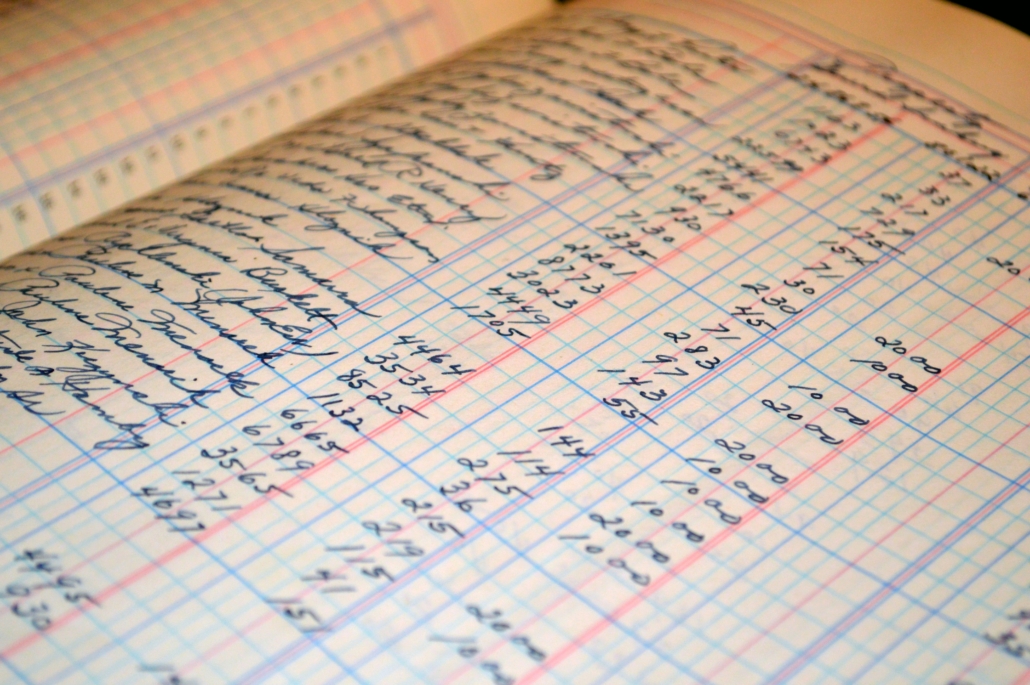

Many entrepreneurs have considered paying for the services of a bookkeeper to help them with financial management. However, there are other ways that entrepreneurs can guarantee that proper financial management strategies are implemented properly.

Join Conference Room: An accounting, personal finance, and entrepreneur community. Video, blog posts, live chats.

Contents

Financial management decisions

Businesses will not be able to succeed without proper financial management. After all, financial management deals with cash flow and financial decisions. Not only is financial management important for businesses, but it also affects the business’ customers as well.

Without financial planning, a company’s employees might not be paid on time or at all, which would lead to poor morale among staff members. Customers will lose out, because they cannot rely on businesses that do not manage their finances properly.

Financial planning is a wise idea for entrepreneurs to consider, since it will ensure that their business operations are well-planned and organized. This way, companies can set aside funds without going into debt or incurring expenses that they cannot afford to pay back later on in the future.

Here are more reasons why financial management is important for businesses:

Smart debt management

Entrepreneurs should do everything they can to avoid debts. However, there are times when financial planning fails and financial management is not done properly. As a result, entrepreneurs have no other choice but to take out loans to keep their businesses in operation.

For example, a company might receive funds from financial institutions, but not utilize the money effectively due to poor financial planning. Because of this, entrepreneurs will face a lot of debts that could lead to the failure of a business down the line. To improve financial decision-making and prevent such issues, working with a fee based financial advisor can help entrepreneurs create effective financial plans and manage their resources wisely. Therefore, entrepreneurs should plan their finances carefully and find ways on how to avoid debts altogether.

Avoid bankruptcy through management

Bankruptcy is something that every business should avoid. This is because bankruptcy can lead to financial disasters and other problems that could affect a company’s reputation.

For example, a company might not have enough funds to cover its operating expenses and meet other financial obligations. However, this does not mean that entrepreneurs need to give up on their dreams of running successful businesses. To avoid financial problems that could result in bankruptcy, entrepreneurs should invest in good financial management strategies.

Using financial resources

With proper financial planning, entrepreneurs will be able to maximize every financial resource they have at hand. This includes using funds from loans efficiently and making sure that finances are allocated properly for various financial obligations.

However, financial management is not just about spending the right amount of money following financial plans; it’s also allocating funds to different financial goals and ensuring there are enough resources for emergencies or unexpected events later on.

Reducing costs

Maintaining good financial management can help businesses reduce costs by staying within budget limits and ensuring financial stability. Plenty of businesses cut costs by eliminating human resources, but this can cost the company more money in the long run, since they will then have to hire new employees and train them on how things work at their business.

By cutting financial corners, businesses also risk losing customers who prefer doing business with financially sound companies. This financial instability can also prevent businesses from expanding their operations to new locations.

Managing risks

Entrepreneurs should do everything that they can to avoid risks as much as possible. This is because financial risks can cause businesses to lose a lot of money and fail to achieve financial instability. This financial instability could also force them to close their doors for good.

Investing in Financial Management

Financial management is very important for businesses because it helps them save money, maintain financial stability, stay within budget limits, and avoid financial risks. Financially successful businesses have a stable source of income, which provides the company with enough cash flow to meet all expenses. For businesses to achieve financial stability, entrepreneurs must invest in good financial management strategies.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and finance:

https://www.accountingaccidentally.com/

Good luck!

Ken Boyd