What Airbnb’s Profit Struggles Teach Us About Contribution Margin (Blog post with graphics)

I like Airbnb, and I’ve used the service multiple times.

The company has huge brand awareness, but was struggling to produce consistent profits in early 2020.

What Happened

The Wall Street Journal wrote about Airbnb’s 2020 profit struggles, as it considered launching an IPO. Here are some quotes:

“The company is the largest home-sharing platform in the U.S., with more than two million people on average booked every night into its listings worldwide.

The board in recent weeks grilled executives on why expenses are outpacing revenue, the people said.

Airbnb increased its revenue to $1.65 billion in the third quarter, up almost $400 million from a year earlier, one of the people said. But costs rose faster. Net profit for the quarter was $266 million—less than the $337 million profit for the same period in 2018.”

Airbnb’s costs will increase in several areas.

Safety program

Costs are likely to increase further, as a result of Airbnb’s recent move to spend more on safety issues affecting its platform. The company has struggled with theft, prostitution and other crimes among its hosts and guests since its founding in 2008.

Technology

Airbnb is also spending heavily on upgrading the technology of its platform, with costs running at more than $100 million a year, a person close to the company said.

Home office costs

One category of costs that has grown particularly fast is general and administrative expenses, which more than doubled year-over-year to total $175 million in the third quarter, according to another person close to the company. This category covers business overhead, such as the costs to run Airbnb’s San Francisco headquarters, and legal, accounting and human-resource functions.

Company growth is difficult to manage, and one useful accounting tool is contribution margin.

Contribution Margin

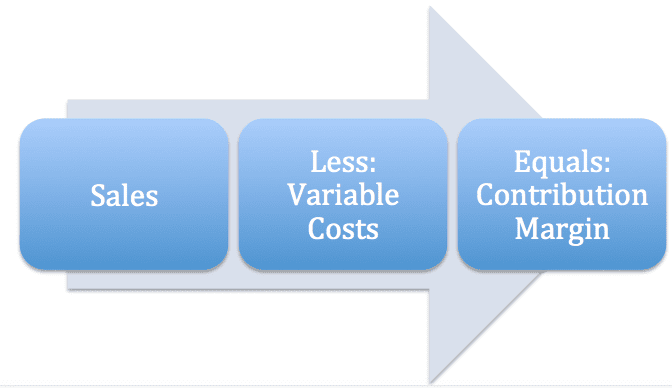

In my Accounting All-In-One For Dummies book, I define contribution margin as sales less variable costs.

Contribution margin covers your fixed costs, and the amount that remains is your profit.

Here’s a simple example:

Julie’s hardware store generates $600,000 in sales and $200,000 in variable costs. Her contribution margin is ($600,000 – $200,000), or $400,000. The $400,000 covers her $250,000 in fixed costs (rent, insurance premiums), and the remainder is a $150,000 profit.

Which brings us to the problem at Airbnb.

The goal is to grow sales at a faster percentage rate than your variable costs and your total fixed costs. When using contribution margin, always look at fixed costs in total dollars, not per unit. Think of fixed costs as a set amount of money that your have to pay, before you compute profitability. These three components impact your profitability:

Airbnb’s costs are growing at a faster rate than sales- both fixed costs and variable costs.

So, what to do?

The Lesson

You can’t “outrun” increasing costs by simply selling more. Cost control is a management issue, and if you make smart decisions about costs, you can improve profits- even in flat sales year.

For live CPA exam prep and accounting classes, join Conference Room for free. Members will be notified of course dates, times, costs, and how to attend these courses.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/