Effective Interest Method: Accounting for Bond Premiums and Discounts (3 Video Links)

If you’ve taking an intermediate accounting class, or studying for the CPA exam, you may struggle with the effective interest method for bond accounting.

You’re not alone.

I’ve always thought that this topic was difficult for many instructors to teach. I started my career as a financial advisor, and my entire client base purchased bonds. So, I had to explain bond premiums and discounts to investors each day.

The experience helps.

Premiums and discounts

A bond’s par value or face value is the dollar amount started on the bond certificate. Let’s assume that you purchase a $1,000 par value bond.

- Premium bond: Investor pays more than the par amount, or more than $1,000. Buying the bond for $1,050 would mean purchasing at a premium.

- Discount bond: Investor pays less than par amount, or less than $1,000. A bond purchased at $980 would be at a discount.

How do you account for the difference between the par (face) amount and the purchase price?

Effective interest method: Discount bonds

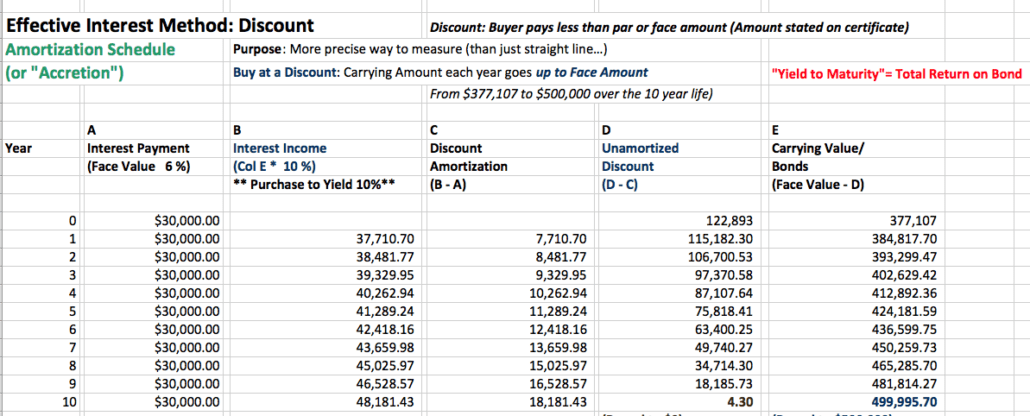

This video and this second video explain purchasing a bond at a discount. In this example, a $500,000 face amount bond is purchased at $377,107:

The far right column shows a beginning carrying value of $377,107. Over the bond’s remaining 10-year life until maturity, the carrying value is increased each year to $500,000 (with rounding).

On the far left, you see that the investor earns annual interest of ($500,000 X 6%), or $30,000. That amount is fixed.

You’ll also note that phrase “purchased to yield 10%”. That phrase refers to the investor’s total return (yield to maturity) over 10 years. The investor earns 6% annual interest plus the difference between the purchase price and the face amount. That amount is the unamortized discount when the bond is purchase, or $122,892 in this case.

In year 1, the spreadsheet multiplies the carrying amount ($377,107) by the 10% yield percentage, which equals $37,710.70. The difference between that amount and the $30,000 in interest ($7,710.70) is added to the carrying value for the start of year 2.

$7,710.70 is also reclassified from the unamortized discount account into bond income. Over 10 years, the entire $122,892 unamortized discount account is moved into bond income.

Effective interest method: Premium bonds

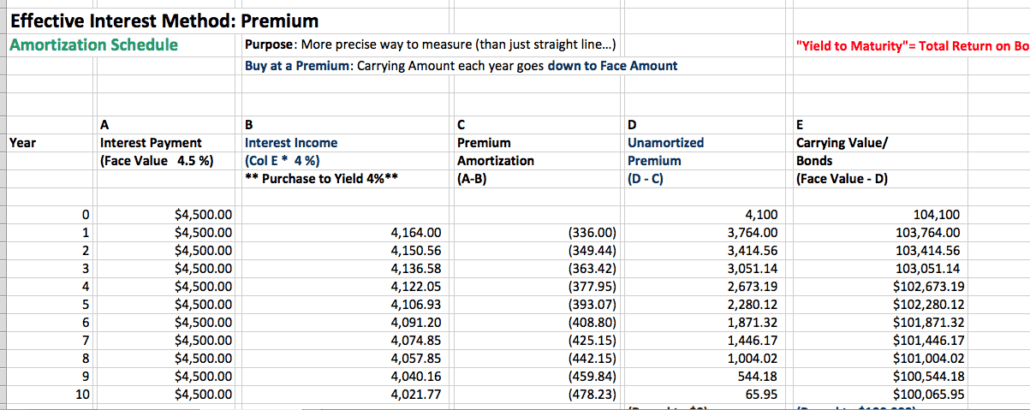

This video explains purchasing a bond at a premium. In this case, a $100,000 face amount bond is bought for $104,100:

The far right column shows a beginning carrying value of $104,100. Over the bond’s remaining 10-year life until maturity, the carrying value is decreased each year to $100,000 (with rounding).

On the far left, you see that the investor earns annual interest of ($100,000 X 4.5%), or $4,500. That amount is fixed.

You’ll also note that phrase “purchased to yield 4%”. That phrase refers to the investor’s total return (yield to maturity) over 10 years. The investor earns 4.5% annual interest less the difference between the purchase price and the face amount. That amount is the unamortized premium when the bond is purchase, or $4,100 in this case.

In year 1, the spreadsheet multiplies the carrying amount ($104,100) by the 4% yield percentage, which equals $4,164. The difference between that amount and the $4,500 in interest ($336) is subtracted from the carrying value for the start of year 2.

$336 is also reclassified from the unamortized premium account into bond expense. Over 10 years, the entire $4,100 unamortized premium account is moved into bond expense.

For live CPA exam prep and accounting classes, join Conference Room for free. Members will be notified of course dates, times, costs, and how to attend these courses.

Get your questions answered to pass the CPA exam, and to learn accounting concepts.

Go to Accounting Accidentally for 300+ blog posts and 450+ You Tube videos on accounting and finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/